Credit: Image by inboundREM | Source

Closing costs are the fees and charges associated with the settlement of a real estate transaction. This includes appraisal fees, title insurance, loan origination fees, and attorney fees, among others.

Whether you’re a buyer or a seller, one of the crucial questions you need to be asking is, “How much are closing costs in TN?” Knowing these costs will enable you to prepare your budget for your home purchase.

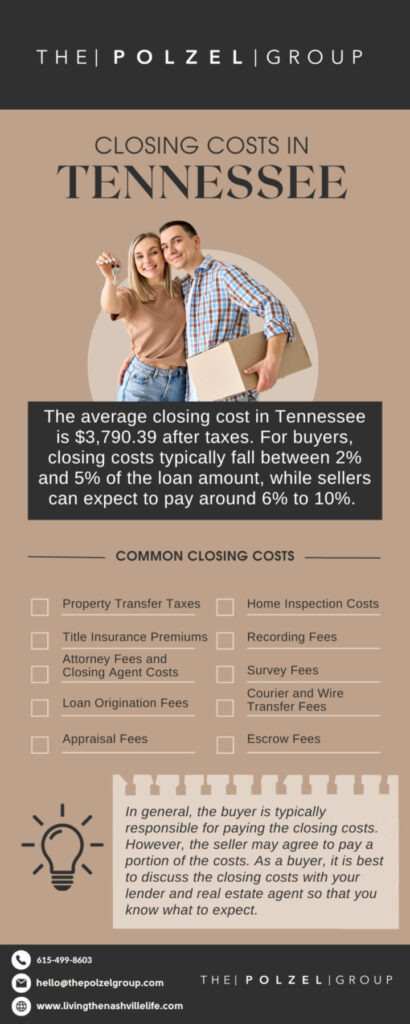

For home buyers in Tennessee, closing costs typically fall between 2% and 5% of the loan amount. On the other hand, sellers can expect to pay around 6% to 10%. The average closing cost in Tennessee is $3,790.39 after taxes.

In this article, we enumerate the common closing costs in the state of Tennessee and provide you with other relevant information about the settlement process.

Exploring Tennessee's Closing Costs Landscape

Real estate closing or settlement is the final step in buying or selling a property in Tennessee. This involves three things:

- The transfer of ownership from the seller to the buyer.

- The disbursement of funds.

- The signing of documents.

In general, these are the key players in a real estate settlement or closing:

- Buyers and sellers

- Real estate agents

- Lender

- Title company representative

- Attorney (optional)

- Escrow agent

Several documents are involved in a real estate closing, each having a specific purpose. These include:

- The closing disclosure

- The deed

- The bill of sale

- The affidavit of title

- The transfer tax declaration

Photo by RDNE Stock project

Understanding the Basics

While your real estate agent and/or attorney may play a critical role in assisting you during the entire transaction, up to the settlement, you, the buyer or seller, should also take measures to ensure that you are ready before the closing date.

Familiarize yourself with the timeline of a closing. Working closely with your real estate agent and lender will help avoid any delays or issues.

Carefully review the disclosure document. This outlines all the financial details of the real estate transaction. Check and make sure that all the information in this document is accurate and complete.

Secure homeowner’s insurance. This is usually required by lenders before closing to protect their investment.

Do a final walkthrough in the presence of the seller. Check to make sure that the property is in the same condition as when you made the offer. If you notice any issues or discrepancies, the seller should address these before closing.

Prepare the funds required for closing. These include the down payment, closing costs, and any other fees or expenses associated with the transaction.

So, how much are closing costs in Tennessee?

Photo by RDNE Stock project

Property Transfer Taxes

Transfer tax is one of the most common closing costs for sellers. This amounts to 0.37% of the property’s sale price, so if the selling price is $200,000, the seller will pay around $740 in transfer taxes.

Title Insurance Premiums

This protects the buyer in case a problem arises from the previous title ownership, from clerical errors in the paperwork to serious problems like full disputes over ownership. The average cost of Tennessee title insurance is 0.56% of the home’s sale price.

Attorney Fees and Closing Agent Costs

Unlike other states, Tennessee does not require a real estate attorney to handle home sales. However, if you choose to seek professional legal advice, the average real estate attorney fees is between $150 and $350 per hour.

Loan Origination Fees

Some mortgage lenders charge buyers a loan origination fee to process the loan and prepare the necessary documentation. The loan origination fee usually amounts to 1% of the mortgage loan amount.

Appraisal Fees

Appraisal fees are paid to the professional appraiser (certified/licensed under the Tennessee Appraisal Board) to assess the home value and ensure you get the best competitive price. The cost for home appraisal in Tennessee ranges between $300 and $500.

Escrow Fees

Escrow fees are paid directly to an escrow company, real estate attorney, or title company to conduct the closing and distribute funds to the third parties involved in the real estate transaction.

This cost averages between $1,500 and $3,000 and varies depending on the time of year you buy, the amount of annual property tax, and hazard insurance.

Home Inspection Costs

A home inspection helps to identify any major defects and issues, like plumbing issues and water damage, in the house. “How much is a home inspection in Tennessee?” The average cost is between $400 and $600.

Recording Fees

In Tennessee, the recording fee is paid by the seller to make the real estate transaction a matter of public record. This fee ranges from $600 to $700 across different counties.

Survey Fees

A land survey determines the exact location and boundaries of a property. The cost may start from $250 and may increase depending on the size of the land.

Photo by RDNE Stock project

Navigating the Process Effectively

The best way to ensure a smooth real estate transaction is to work with a reliable real estate agent in Tennessee who will guide you throughout the process. Aside from determining how much the closing costs will be, you may be discussing with your realtor ways to lower these costs.

Negotiating with Lenders and Service Providers

There are several ways buyers and sellers can reduce closing costs. Here are some of them:

- Shop around for services

- Negotiate fees

- Take advantage of down payment assistance programs

- Buyer incentives

- Time their closing date at the end of the month

Photo by Mikhail Nilov

Common Pitfalls to Avoid

All it takes is one small slip-up or missed detail for your closing to be delayed. Sometimes, the delay can be just a few days, but this may take longer. Here are a few things to avoid.

One common mistake is failing to submit proper documentation to your lender during the loan application. Without this, your lender will not be able to issue the final loan approval.

It’s important for your lender to get all the requirements for your home loan as soon as possible so they have enough time to review these prior to closing. And, if they will be asking for additional documents, you will have sufficient time to provide those as well.

Another common mistake that can delay closing is assuming that your pre-approval translates to the approval of your loan. Changes to credit, income, or debt can happen during the loan approval process, and these can delay closing or cause your loan to be denied altogether.

Conclusion

Real estate closing can be complex, but with a little time, effort, and preparation, you can ensure a smooth transaction.

If you’re interested in buying a home in Nashville or other parts of Tennessee, our team will be glad to help! Feel free to contact us today at 615-499-8603 or 503-332-9469 so we can start discussing about your dream home. You may also send us an email at hello@thepolzelgroup.com.

Frequently Asked Questions

What are typical closing costs in Tennessee?

Some of the common closing costs in Tennessee are property transfer taxes, title insurance premiums, attorney fees and closing agent costs, loan origination fees, appraisal fees, escrow fees, home inspection costs, recording fees, and survey fees.

How can I estimate my closing costs in Tennessee?

For home buyers in Tennessee, closing costs typically fall between 2% and 5% of the loan amount, while sellers can expect to pay around 6% to 10%.